Urgent: File before your federal deadline so you can avoid a penalty of $500/day.

Your Trusted Partner In Compliance

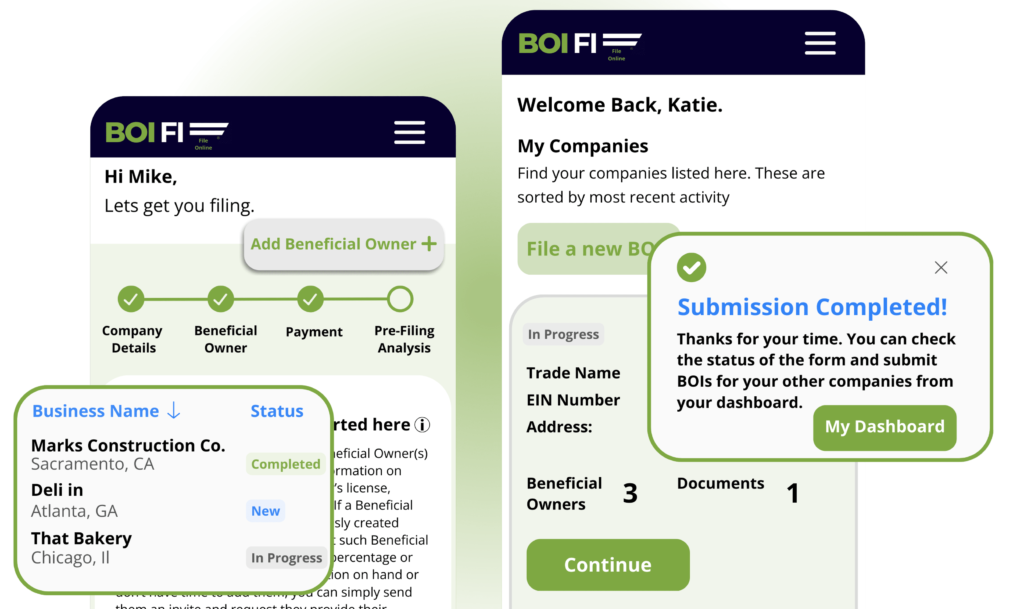

BOI FI: purpose-built For securely Filing your Beneficial Ownership Information Report

BOI FI: purpose-built For securely Filing your Beneficial Ownership Information Report

What is the BOI Report?

Effective January 1, 2024, all US and foreign companies that were formed in, or have registered with any of the 50 US states, must comply with new Beneficial Ownership Information (BOI) reporting requirements with the Financial Crimes Enforcement Network (FinCEN), as prescribed by the Corporate Transparency Act (CTA).

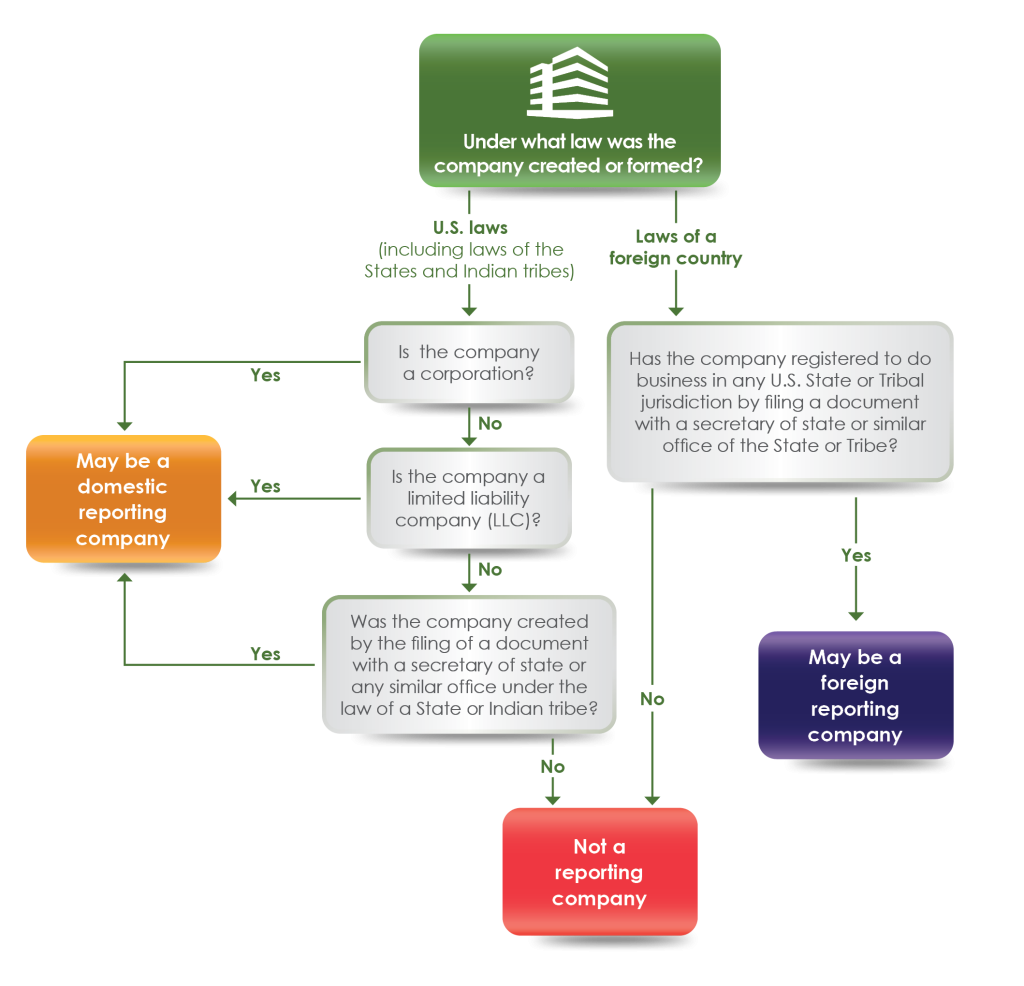

Reporting Company

The BOI Report is required to be filed by reporting companies entities starting January 1, 2024.

Beneficial Owner

The BOI Report include information about the reporting company, the reporting company’s beneficial owners, and “company applicants” who assisted with the filings to create the entity.

Entities required to report are called reporting companies

- 1. Domestic reporting companies are corporations, limited liability companies, and any other entities created by the filing of a document with a secretary of state or any similar office in the United States.

- 2. Foreign reporting companies are entities (including corporations and limited liability companies) formed under the law of a foreign country that have registered to do business in the United States by the filing of a document with a secretary of state or any similar office.

- 3. There are 23 types of entities that are exempt from the reporting requirements.

Why use BOI FI to file a BOI Report?

Become Compliant in 2024

Satisfy the Corporate Transparency Act requirement with our help. We’ll file the information about the individuals who own or control your business with the Financial Crimes Enforcement Network (FinCEN).

Fast and Easy

Save time with BOI Fi through the complexities of a new federal law with our fast and easy report filing. We’ll ensure your filing meets all the requirements of the Corporate Transparency Act.

File with Confidence

Get peace of mind with our accurate, compliant filing. You can be sure that we’ll include all information required by FinCEN and the new law. Plus, you’ll receive confirmation upon completion of the report.

File Your Report in 3 Easy Steps

Get assisted with the Beneficial Ownership Information Report?

Avoid serious penalties

Avoid criminal and civil penalties, including imprisonment for up to two years and/or fines of up to $10,000, and civil fines of up to $500/day.

focus on your business growth

Focus on your business growth and clients instead of navigating the complexities of a new federally mandated rule under the Corporate Transparency Act.

Confidence

Feel confident and secure about your business, knowing you’re in compliance with the Financial Crimes Enforcement Network (FinCEN).

Due Date Calculator

business incorporation date

When is my due date?

What is the Beneficial Ownership Information Reporting Rule?

This rule is designed to enhance transparency regarding company ownership structures, enabling the federal government to combat financial crimes and fraudulent activities. These include but are not limited to money laundering, corruption, human trafficking, drug trafficking, tax fraud, and various forms of deception targeting employees, customers, and other businesses.

By requiring beneficial ownership information reporting, the rule aligns with the ongoing commitment and initiatives of the U.S. government to discourage corporations from concealing or profiting from actions that inflict harm on others.

Who is a Beneficial Owner?

A beneficial owner under the Corporate Transparency Act is an individual who directly or indirectly: (1) owns or controls at least 25% of your company’s ownership interests, or (2) exercises substantial control over your business. Common examples of someone that exercises substantial control can include the following (as per FinCen) :

- An important decision-maker for the reporting company

- A senior officer (President, CEO, CFO, COO, general counsel, or any other officer)

- Individual with authority to appoint or remove certain officers or directors

What are the penalties for not filing?

Noncompliance may result in criminal repercussions, including imprisonment for up to two years and/or a fine reaching $10,000. Additionally, civil penalties can be levied, amounting to up to $500 per day.

Even in cases where a reporting company submits the report punctually, penalties may be imposed if the information therein is inaccurate. Ensuring precision in the reporting company’s filing is imperative. We can assist you in achieving accurate filing through a streamlined reporting and filing process that aligns with the relevant legislation.

When is the Beneficial Ownership Information Report deadline?

The Beneficial Ownership Information Reporting Rule, effective since January 1, 2024, necessitates prompt attention to understand and meet the requirements. Your filing deadline is contingent on your formation date, a detail we can assist in determining. Receive timely notifications from us leading up to your deadline to stay on track.

For businesses formed before January 1, 2024, the deadline for filing is December 31, 2024. Entities formed on or after January 1, 2024, have a 90-day window post-formation. Entities amending formation documents after January 1, 2024, must file within 30 days.

Addressing this obligation promptly is crucial to avoid severe consequences, including imprisonment for up to two years, a fine of up to $10,000, and/or a daily fine of up to $500 for noncompliance.

How do I file a BOI Report?

Then, we’ll file for you in a timely manner with the Financial Crimes Enforcement Network (FinCEN) and confirm successful completion for your peace of mind that you’ve satisfied the compliance requirement.

What is in the BOI Report?

The Beneficial Ownership Information Report includes several pieces of information about the reporting company, such as its full legal name, any trade or DBA names, its address, federal tax ID number (or EIN), and the jurisdiction where it was created.

The report also includes the owners’ full legal names, birth dates, current addresses, images of acceptable identification documents (such as a passports or driver’s licenses), along with the issuing jurisdiction and the document’s ID number. If the person who filed your entity formation documents (known as the applicant) is not one of the beneficial owners, the applicant must also provide the same information as the beneficial owners.

Using our service simplifies the process for reporting and filing the required information with the Financial Crimes Enforcement Network, saving you time and stress related to deadlines and accurate filing of your report.

How are LLCs Affected by the BOI Reporting Law?

Who is Exempt from BOI Reporting?

Most small business entities are not exempt from this requirement. Entities that are exempt from beneficial ownership information reporting include publicly traded companies, tax-exempt nonprofit organizations, certain large operating companies, and others that meet specific requirements. The Financial Crimes Enforcement Network lists 23 types of exempt entities that do not qualify as reporting companies and certain individuals that can’t be listed as a beneficial owner under the reporting requirement.

File My BOI Report

File My

BOI Report

Frequently Asked Questions

Beneficial ownership information refers to identifying information about the individuals who directly or indirectly own or control a company.

- Very few U.S. states or territories require companies to disclose information about their beneficial owners—the individuals who own or control companies. This lack of transparency allows criminals, corrupt officials, and other bad actors to hide their identities and launder illicit funds through the United States using shell and front companies. This in turn hurts ordinary Americans because the lack of transparency results in an uneven playing field for honest and legitimate U.S. businesses. The inaccessibility of beneficial ownership information also makes it hard for law enforcement to track and prosecute criminal activity.

- In 2021, Congress, with bipartisan support, enacted the Corporate Transparency Act to address this problem. The Corporate Transparency Act requires certain types of U.S. and foreign entities to report information about their beneficial owners to the Treasury Department’s Financial Crimes Enforcement Network, commonly known as FinCEN. FinCEN is responsible for safeguarding the U.S. financial system from illicit use. Subject to strict safeguards and controls, FinCEN will disclose the reported beneficial ownership information to certain authorized government authorities, financial institutions, and other authorized users.

- By collecting beneficial ownership information and sharing it with law enforcement, financial institutions, and other authorized users, FinCEN is making it harder for bad actors to hide or benefit from their ill-gotten gains. Companies that report beneficial ownership information will contribute to this important goal.

Yes. Starting January 1, 2024 entities will need to report beneficial ownership information to FinCEN. FinCEN is currently accepting all beneficial ownership information reports.

FinCEN has began accepting beneficial ownership information reports, starting January 1, 2024. Beneficial ownership information reports are being accepted now.

Use our free "DUE DATE CALCULATOR" to find out when your business needs to file the BOI Report.

- Certain companies — referred to as “reporting companies” — will be required to report their beneficial ownership information to FinCEN. There are two types of reporting companies — domestic reporting companies and foreign reporting companies. A domestic reporting company is defined as —

- a corporation,

- a limited liability company, or

- any other entity created by the filing of a document with a secretary of state or any similar office under the law of a state or Indian tribe.

- A foreign reporting company is any entity that is —

- a corporation, limited liability company, or other entity formed under the law of a foreign country, AND

- registered to do business in any U.S. state or in any Tribal jurisdiction, by the filing of a document with a secretary of state or any similar office under the law of a U.S. state or Indian tribe.

- If you had to file a document with a state or Indian Tribal-level office such as a secretary of state to create your company, or to register it to do business if it is a foreign company, then your company is a reporting company, unless an exemption applies.

- For the definitions of both domestic and foreign reporting companies, a “state” means any state of the United States, the District of Columbia, the Commonwealth of Puerto Rico, the Commonwealth of the Northern Mariana Islands, American Samoa, Guam, the U.S. Virgin Islands, and any other commonwealth, territory, or possession of the United States.

- Protecting the security and confidentiality of beneficial ownership information is a top priority for FinCEN. Federal law requires FinCEN to implement protocols to safeguard beneficial ownership information, to build a secure IT system to store the information, and to establish processes and procedures to ensure that only authorized users can access beneficial ownership information for authorized purposes.

- FinCEN is developing the policies and procedures that will govern access to and handling of beneficial ownership information. FinCEN is also building a secure and confidential IT system to store the information. Consistent with Federal law, the system will be cloud-based, and will meet the highest Federal Information Security Modernization Act (FISMA) level to keep beneficial ownership information secure.

- FinCEN will work closely with those authorized to access beneficial ownership information to ensure that they understand their roles and responsibilities to ensure that the reported information is used only for authorized purposes and handled in a way that protects its security and confidentiality.

- In general, a beneficial owner is any individual (1) who directly or indirectly exercises “substantial control” over the reporting company, or (2) who directly or indirectly owns or controls 25 percent or more of the “ownership interests” of the reporting company.

- Whether an individual has “substantial control” over a reporting company depends on the power they may exercise over a reporting company. For example, an individual will have substantial control of a reporting company if they direct, determine, or exercise substantial influence over, important decisions the reporting company makes. In addition, any senior officer is deemed to have substantial control over a reporting company. *Other rights or responsibilities may also constitute substantial control. Additional information about the definition of substantial control and who qualifies as exercising substantial control can be found in the Beneficial Ownership Information Reporting Regulations at 31 CFR §1010.380(d)(1).

- “Ownership interests” generally refer to arrangements that establish ownership rights in the reporting company, including simple shares of stock as well as more complex instruments. Additional information about ownership interests, including indirect ownership, can be found in the Beneficial Ownership Information Reporting Regulations at 31 CFR §1010.380(d)(2).

- FinCEN expects that the majority of reporting companies will have a simple ownership and control structure. A few examples of how to identify beneficial owners are described below.

- Example 1: The reporting company is a limited liability company (LLC). You are the sole owner and president of the company and make important decisions for the company. No one else owns or controls ownership interests in your company or exercises substantial control over your company.

- You are a beneficial owner of the reporting company in two different ways, assuming no other facts. First, you exercise substantial control over the company because you are a senior officer of the company (the president) and because you make important decisions for the company. Second, you are also a beneficial owner because you own 25 percent or more of the reporting company’s ownership interests.

- Because no one else owns or controls ownership interests in your LLC or exercises substantial control over it, and assuming there are no other facts to consider, you are the only beneficial owner of this reporting company, and your information must be reported to FinCEN.

- Example 2: The reporting company is a corporation. The company’s total outstanding ownership interests are shares of stock. Three people (Individuals A, B, and C) own 50 percent, 40 percent, and 10 percent of the stock, respectively, and one other person (Individual D) acts as the President for the company, but does not own any stock.

- Assuming there are no other facts, Individuals A, B, and D are all beneficial owners of the company and their information must be reported. Individual C is not a beneficial owner.

- Individual A owns 50 percent of the company’s stock and therefore is a beneficial owner because they own 25 percent or more of the company’s ownership interests.

- Individual B owns 40 percent of the company’s stock and therefore is a beneficial owner because they own 25 percent or more of the company’s ownership interests.

- Individual C is not a company officer and does not directly or indirectly exercise any substantial control over the company.

- Individual C also owns 10 percent of your company’s stock, which is less than the 25 percent or greater interest needed to qualify as a beneficial owner by virtue of ownership interests. Individual C is therefore not a beneficial owner of the company.

- Individual D is president of the company and is therefore a beneficial owner. As a senior officer of the company, Individual D exercises substantial control, regardless of whether the individual owns or controls 25 percent or more of the company’s ownership interests.

- Example 3: The reporting company is a corporation owned by four individuals who each own 25 percent of the company’s ownership interests (e.g., shares of stock). Four other individuals serve as the reporting company’s CEO, CFO, COO, and general counsel, respectively, none of whom hold any of the company’s ownership interests.

- In this example, there are eight beneficial owners. All four of the individuals who each own 25 percent of the company’s ownership interests are beneficial owners of the company by virtue of their holdings in it, even if they exercise no substantial control over it. The CEO, CFO, COO, and general counsel are all senior officers and therefore exercise substantial control over the reporting company, making them beneficial owners as well.

- The term “senior officer” means any individual holding the position or exercising the authority of a president, chief financial officer, general counsel, chief executive officer, chief operating officer, or any other officer, regardless of official title, who performs a similar function. 31 CFR 1010.380(f)(8).

- Learn more

- Yes. The information that needs to be reported, however, depends on when the company was created or registered.

- If a reporting company is created or registered on or after January 1, 2024, the reporting company will need to report information about itself, its beneficial owners, and its company applicants.

- If a reporting company was created or registered before January 1, 2024, the reporting company only needs to provide information about itself and its beneficial owners. The reporting company does not need to provide information about its company applicants.

A reporting company will have to report:

- Its legal name;

- Any trade names, “doing business as” (d/b/a), or “trading as” (t/a) names;

- The current street address of its principal place of business if that address is in the United States (for example, a domestic reporting company’s headquarters), or, for reporting companies whose principal place of business is outside the United States, the current address from which the company conducts business in the United States (for example, a foreign reporting company’s U.S. headquarters);

- Its jurisdiction of formation or registration; and

- Its Taxpayer Identification Number.

A reporting company will also have to indicate the type of filing it is making (that is, whether it is filing an initial report, a correction of a prior report, or an update to a prior report).

- For each individual who is a beneficial owner or a company applicant, a reporting company will have to report:

- The individual’s name, date of birth, and address;

- A unique identifying number from an acceptable identification document; and

- The name of the state or jurisdiction that issued the identification document.

- Address: For a beneficial owner, the reporting company must report the residential street address.

- For a company applicant, the reporting company must report the individual’s residential street address. However, if an individual engages in the business of corporate formation (e.g., as an attorney or corporate formation agent) and files the formation or registration document in the course of that business, then the reporting company must report the current street address of the company applicant’s business. For example, if the company applicant is a paralegal who filed the document while working at a law firm, the reporting company must report the business address of the law firm where the paralegal worked when filing the document.

- Identification Document: The list below sets out the forms of acceptable identification documents:

- A non-expired driver’s license issued by a U.S. state. A “U.S. state” means any state of the United States, the District of Columbia, the Commonwealth of Puerto Rico, the Commonwealth of the Northern Mariana Islands, American Samoa, Guam, the U.S. Virgin Islands, and any other commonwealth, territory, or possession of the United States.

- A non-expired identification document issued by a U.S. state or local government, or Indian Tribe that is issued for the purpose of identifying the individual. For example, a non-driver identification card issued by a state Department of Motor Vehicles would qualify because it is issued for identification purposes.

- A non-expired passport issued by the U.S. government; or

- If the individual does not have any of the three forms of identification document described above, the reporting company may provide the identifying number from a non-expired passport issued by a foreign government.

- In addition, the reporting company must submit an image of the identification document associated with the unique identifying number reported to FinCEN.

BOI FI handles it. Our team will reach out to you before the filing due date to confirm there has been no change in information and confirm we are able to proceed with filing the information the client disclosed.

- The Corporate Transparency Act authorizes FinCEN to disclose beneficial ownership information in certain circumstances to six types of requesters:

- U.S. Federal agencies engaged in national security, intelligence, and law enforcement activities;

- State, local, and Tribal law enforcement agencies with court authorization;

- The U.S. Department of the Treasury;

- Financial institutions using beneficial ownership information to conduct legally required customer due diligence, provided the financial institutions have their customer consent to retrieve the information;

- Federal and state regulators assessing financial institutions for compliance with legally required customer due diligence obligations; and

- Foreign law enforcement agencies and certain other foreign authorities who submit qualifying requests for the information through a U.S. Federal agency.

- The Corporate Transparency Act imposes stringent access requirements and safeguards on each group of requesters.

See What Our Clients Have To Say

See What Our Clients

Have To Say

At the heart of everything we do is our commitments to helping our clients achieve more.